Introducing DeepFeatTimeGPT

The field of financial forecasting has long been dominated by

traditional methods like linear regression models, spreadsheets,

and manual work. However, recent advancements in deep learning

have opened up new possibilities for more accurate and efficient

forecasting.

traditional methods like linear regression models, spreadsheets,

and manual work. However, recent advancements in deep learning

have opened up new possibilities for more accurate and efficient

forecasting.

One such innovation is DeepFeatTimeGPT, a multimodal,

probabilistic forecasting system based on a neural network

architecture.

probabilistic forecasting system based on a neural network

architecture.

What Sets DeepFeatTimeGPT

Apart

DeepFeatTimeGPT stands out because of its ability to

incorporate multiple data sources and modalities. The

neural network can analyze both structured and

unstructured data to generate more accurate predictions.

incorporate multiple data sources and modalities. The

neural network can analyze both structured and

unstructured data to generate more accurate predictions.

Moreover, the system is probabilistic, providing a range of

possible outcomes and their associated probabilities, rather

than a single-point estimate, thereby accounting for uncertainty.

possible outcomes and their associated probabilities, rather

than a single-point estimate, thereby accounting for uncertainty.

The Training Data

DeepFeatTimeGPT is built on a massive dataset consisting of

nearly 1 billion months of financial history from 1,500,000

companies in 47 sectors and 744 industries across 100

countries. This data includes 78 different measures, such

as revenue, EBITDA, gross margin, and enterprise value.

nearly 1 billion months of financial history from 1,500,000

companies in 47 sectors and 744 industries across 100

countries. This data includes 78 different measures, such

as revenue, EBITDA, gross margin, and enterprise value.

To put this into perspective, it would take a human over 72 years

of nonstop reading 24/7 to go through all the data. Assuming an

average of 1,716 hours of work per year, it would take about 371

working years to read through the dataset.

of nonstop reading 24/7 to go through all the data. Assuming an

average of 1,716 hours of work per year, it would take about 371

working years to read through the dataset.

If a consulting firm charged $250 per hour to do this research,

the cost would be approximately $159,225,000. This cost only

accounts for the time spent reading the data and does not include

understanding and interpreting the information.

the cost would be approximately $159,225,000. This cost only

accounts for the time spent reading the data and does not include

understanding and interpreting the information.

Benchmarking Study

To assess the effectiveness of DeepFeatTimeGPT compared

to traditional methods used by business strategy consultants

or investment banks, we conducted a benchmarking study using

a dataset of published forecasts by investment banks. The dataset

includes forecasts for three central financial metrics:

to traditional methods used by business strategy consultants

or investment banks, we conducted a benchmarking study using

a dataset of published forecasts by investment banks. The dataset

includes forecasts for three central financial metrics:

- Revenue: Total money earned from sales of products

or services. - EBITDA (Earnings Before Interest, Taxes, Depreciation,

and Amortization): Measures operating performance by

subtracting operating expenses from revenue. - EBT (Earnings Before Taxes): Measures operating performance

by subtracting all operating expenses, including depreciation and

amortization, from revenue but before taxes.

The dataset consists of 407,500 data points for 11,443 public

companies across 70 countries, 47 sectors, and 209 industries.

The number of investment banks included ranges from 2 to 49, with

a median of 12. Each forecast is provided for four quarters into the

future, with data ranging from Q1/1992 to Q4/2022.

companies across 70 countries, 47 sectors, and 209 industries.

The number of investment banks included ranges from 2 to 49, with

a median of 12. Each forecast is provided for four quarters into the

future, with data ranging from Q1/1992 to Q4/2022.

The forecasts are constructed as 95% confidence intervals with

expected (median), lower (5%), and upper (95%) values. To evaluate

DeepFeatTimeGPT’s performance, we created several subsets for

analysis, including all 11,443 companies and a subset of S&P 500 firms.

expected (median), lower (5%), and upper (95%) values. To evaluate

DeepFeatTimeGPT’s performance, we created several subsets for

analysis, including all 11,443 companies and a subset of S&P 500 firms.

The included investment banks in the study can be found below:

Investment Bank Name

Website

Cowen & Co

D.A. Davidson

Rosenblatt Securities

Wedbush

Barclays

KeyBanc

Deutsche Bank

J.P. Morgan

Loop Capitals Market

Piper Sandler

BNB Paribas

Morgan Stanley

Tigress Financial

Goldman Sachs

Credit Suisse

Needham

Newstreet

Citigroup

Evercore ISI

Evaluation Metrics for

DeepFeatTimeGPT

We evaluated the performance of DeepFeatTimeGPT using two

central performance measures for forecasting: sMAPE and

coverage.

central performance measures for forecasting: sMAPE and

coverage.

sMAPE (Symmetric Mean

Absolute Percentage Error)

sMAPE is an accuracy measure based on percentage errors.

It is calculated as the mean of the absolute differences between

the actual and predicted values, divided by the sum of the absolute

values of the actual and predicted values, multiplied by 200%. The

median forecast is used for calculating the sMAPE.

It is calculated as the mean of the absolute differences between

the actual and predicted values, divided by the sum of the absolute

values of the actual and predicted values, multiplied by 200%. The

median forecast is used for calculating the sMAPE.

Coverage

Coverage refers to the proportion of times that a prediction

interval contains the actual outcome. A prediction interval is

a range of values that an event or outcome is expected to fall

within with a certain degree of probability. In probabilistic forecasting,

coverage is an important metric for assessing the accuracy and

reliability of the forecast model.

interval contains the actual outcome. A prediction interval is

a range of values that an event or outcome is expected to fall

within with a certain degree of probability. In probabilistic forecasting,

coverage is an important metric for assessing the accuracy and

reliability of the forecast model.

Evalutation Setting

DeepFeatTimeGPT is evaluated through zero-shot testing,

meaning that the model is tested on a data series it has not

encountered previously. During the benchmark study, the

model sees the data from the companies for the first time.

meaning that the model is tested on a data series it has not

encountered previously. During the benchmark study, the

model sees the data from the companies for the first time.

The purpose of this approach is to evaluate the model’s ability

to generalize to new data, rather than relying on training the

model on the same data that it is evaluated on. This evaluation

method helps to determine the model’s generalization

capability and robustness, which are essential for real-world

forecasting applications, where the future data distribution is

unknown.

to generalize to new data, rather than relying on training the

model on the same data that it is evaluated on. This evaluation

method helps to determine the model’s generalization

capability and robustness, which are essential for real-world

forecasting applications, where the future data distribution is

unknown.

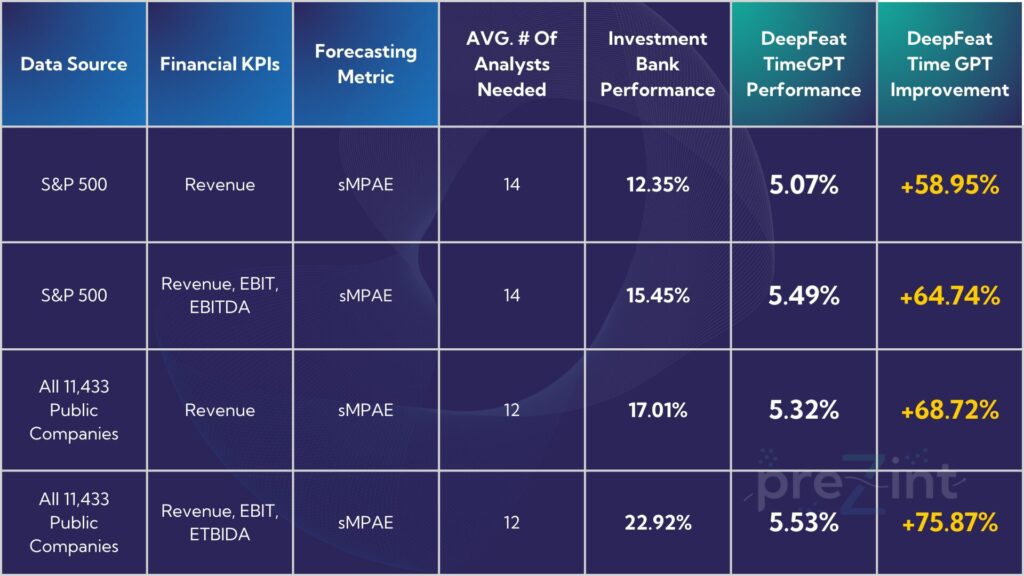

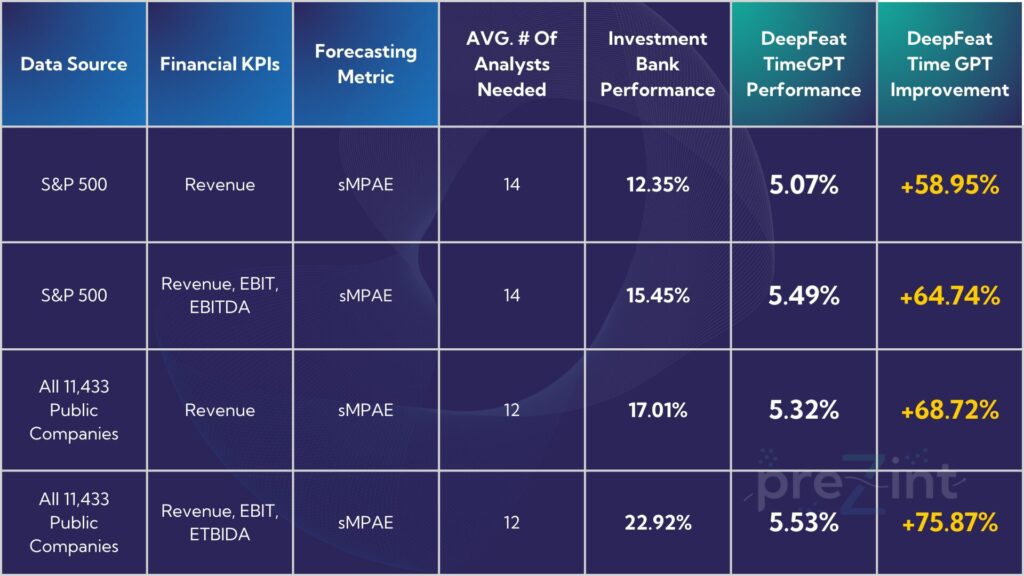

Results of the Benchmarking

Study for sMPAE

It’s important to note that a lower sMPAE % is good & a

higher sMAPE % is not good. Also, the # of analysts is our

estimate of how many analysts would be needed for the investment

banks to create such forecasts. Of course with preZint there would be

none needed to create these forecasts.

higher sMAPE % is not good. Also, the # of analysts is our

estimate of how many analysts would be needed for the investment

banks to create such forecasts. Of course with preZint there would be

none needed to create these forecasts.

The # of analysts needed will become more relevant later when

we calculate potential cost savings when using preZint to output

forecasts.

we calculate potential cost savings when using preZint to output

forecasts.

As you can see for every data source & every financial KPI forecast

DeepFeatTimeGPT far outpeformed these top investment banks.

And, this is just the current model’s performance. At preZint we are

constantly working on improving this & are other 7 models which

we call AI engines.

DeepFeatTimeGPT far outpeformed these top investment banks.

And, this is just the current model’s performance. At preZint we are

constantly working on improving this & are other 7 models which

we call AI engines.

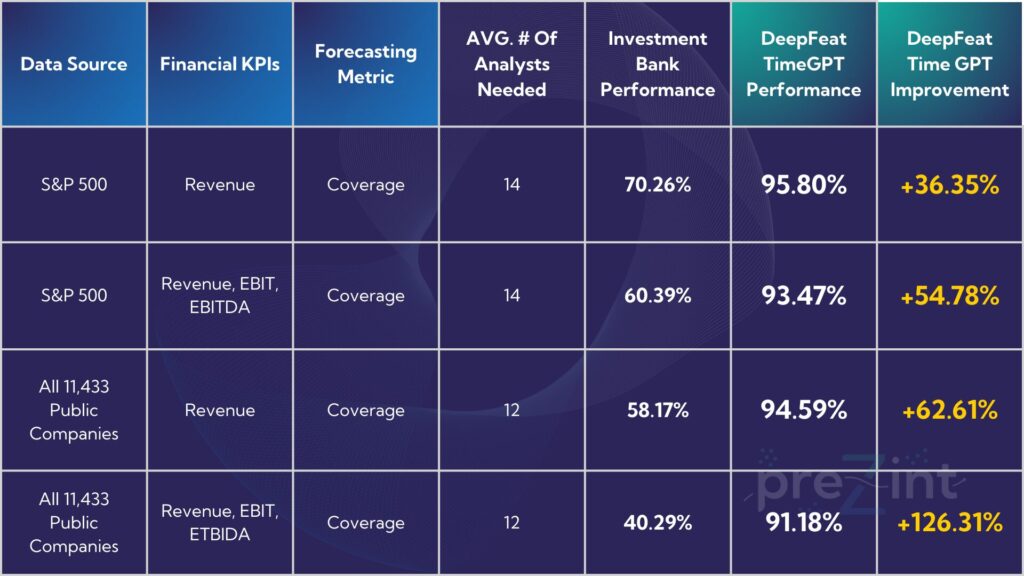

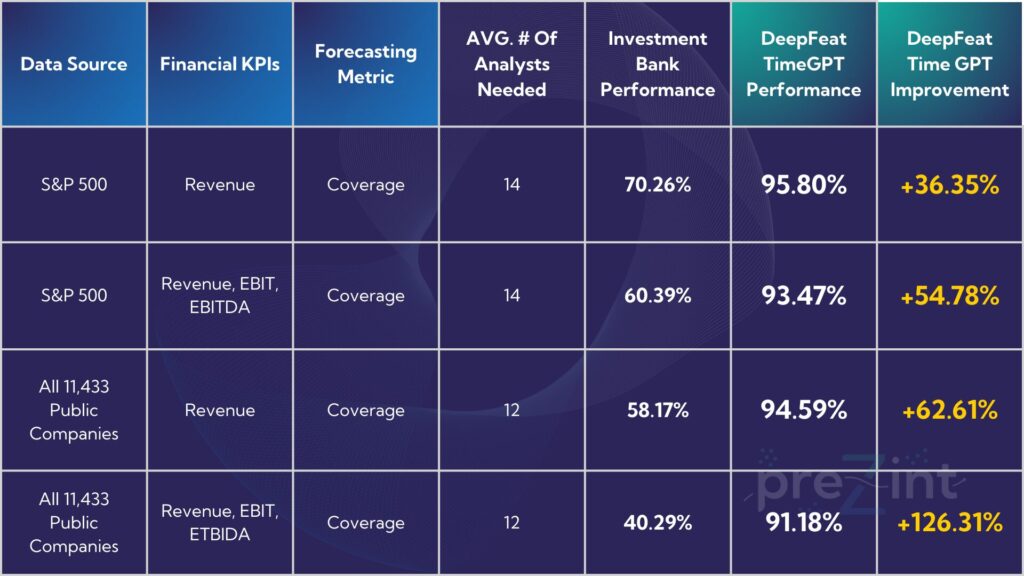

Results of the Benchmarking

Study for Coverage

The below chart is similar to the sMPAE chart. However, this time a

higher % is good & a lower % is not good.

higher % is good & a lower % is not good.

Similar to sMAPE, you can see that in all tests DeepFeatTimeGPT

was able to outperform these investment banks in accuracy by

a wide margin.

was able to outperform these investment banks in accuracy by

a wide margin.

Introducing DeepFeatTimeGPT

The field of financial forecasting has long been dominated by traditional methods like linear regression models, spreadsheets,

and manual work. However, recent advancements in deep learning

have opened up new possibilities for more accurate and efficient

forecasting.

One such innovation is DeepFeatTimeGPT, a multimodal,

probabilistic forecasting system based on a neural network

architecture.

What Sets DeepFeatTimeGPT Apart

DeepFeatTimeGPT stands out because of its ability to

incorporate multiple data sources and modalities. The

neural network can analyze both structured and unstructured data to generate more accurate predictions.

Moreover, the system is probabilistic, providing a range of

possible outcomes and their associated probabilities, rather than a single-point estimate, thereby accounting for uncertainty.

The Training Data

DeepFeatTimeGPT is built on a massive dataset consisting of

nearly 1 billion months of financial history from 1,500,000

companies in 47 sectors and 744 industries across 100

countries. This data includes 78 different measures, such

as revenue, EBITDA, gross margin, and enterprise value.

To put this into perspective, it would take a human over 72 years

of nonstop reading 24/7 to go through all the data. Assuming an average of 1,716 hours of work per year, it would take about 371

working years to read through the dataset.

If a consulting firm charged $250 per hour to do this research, the cost would be approximately $159,225,000. This cost only

accounts for the time spent reading the data and does not include

understanding and interpreting the information.

Benchmarking Study

To assess the effectiveness of DeepFeatTimeGPT compared to traditional methods used by business strategy consultants

or investment banks, we conducted a benchmarking study using

a dataset of published forecasts by investment banks. The dataset

includes forecasts for three central financial metrics:

- Revenue: Total money earned from sales of products or services.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Measures operating performance by subtracting operating expenses from revenue.

- EBT (Earnings Before Taxes): Measures operating performance by subtracting all operating expenses, including depreciation and amortization, from revenue but before taxes.

The dataset consists of 407,500 data points for 11,443 public companies across 70 countries, 47 sectors, and 209 industries.

The number of investment banks included ranges from 2 to 49, with

a median of 12. Each forecast is provided for four quarters into the

future, with data ranging from Q1/1992 to Q4/2022.

The forecasts are constructed as 95% confidence intervals with

expected (median), lower (5%), and upper (95%) values. To evaluate DeepFeatTimeGPT’s performance, we created several subsets for

analysis, including all 11,443 companies and a subset of S&P 500 firms.

The included investment banks in the study can be found below:

Evaluation Metrics for DeepFeatTimeGPT

We evaluated the performance of DeepFeatTimeGPT using two

central performance measures for forecasting: sMAPE and

coverage.

sMAPE (Symmetric Mean

Absolute Percentage Error)

sMAPE is an accuracy measure based on percentage errors.

It is calculated as the mean of the absolute differences between the actual and predicted values, divided by the sum of the absolute

values of the actual and predicted values, multiplied by 200%. The

median forecast is used for calculating the sMAPE.

Coverage

Coverage refers to the proportion of times that a prediction interval contains the actual outcome. A prediction interval is

a range of values that an event or outcome is expected to fall

within with a certain degree of probability. In probabilistic forecasting,

coverage is an important metric for assessing the accuracy and

reliability of the forecast model.

Evalutation Setting

DeepFeatTimeGPT is evaluated through zero-shot testing,

meaning that the model is tested on a data series it has not encountered previously. During the benchmark study, the

model sees the data from the companies for the first time.

The purpose of this approach is to evaluate the model’s ability to generalize to new data, rather than relying on training the

model on the same data that it is evaluated on. This evaluation

method helps to determine the model’s generalization

capability and robustness, which are essential for real-world

forecasting applications, where the future data distribution is

unknown.

Results of the Benchmarking Study for sMPAE

It’s important to note that a lower sMPAE % is good & a

higher sMAPE % is not good. Also, the # of analysts is our estimate of how many analysts would be needed for the investment

banks to create such forecasts. Of course with preZint there would be

none needed to create these forecasts.

The # of analysts needed will become more relevant later when

we calculate potential cost savings when using preZint to output forecasts.

As you can see for every data source & every financial KPI forecast DeepFeatTimeGPT far outpeformed these top investment banks.

And, this is just the current model’s performance. At preZint we are

constantly working on improving this & are other 7 models which

we call AI engines.

Results of the Benchmarking Study for Coverage

The below chart is similar to the sMPAE chart. However, this time a higher % is good & a lower % is not good.

Similar to sMAPE, you can see that in all tests DeepFeatTimeGPT

was able to outperform these investment banks in accuracy by a wide margin.

Book Your Demo

Fill out the form to book your demo

Click green button when done to be directed

to the calendar reservation page.

Your privacy is of our upmost concern. We will not share your information with any third parties. You can request that we delete your information at anytime.

Demo Is

What?

Your demo is the next step creating your customized preZint solution.

Below are some of the key points of the demo.

Below are some of the key points of the demo.

Questionnaire

Complete a questionnaire to understand

your companies specific & unique challenges

your companies specific & unique challenges

Benefit: Tailored insights to ensure

your demo addresses your exact needs

your demo addresses your exact needs

Scheduling

After questionnaire, reserve a date / time for demo.

Demo is held at your office or desired location

Demo is held at your office or desired location

Benefit: See preZint live in person

Live Demonstration

A sales representative & product specialist

will conduct a live demo at your desired location

will conduct a live demo at your desired location

Benefit: See for you industry how preZint

can reduce operational costs by 30%

can reduce operational costs by 30%

Book Your Demo

Fill out the form to book your demo. Click green button when done to be directed to the calendar reservation page.

Your privacy is of our upmost concern. We will not share your information with any third parties. You can request that we delete your information at anytime.

Demo Is

What?

Your demo is the next step creating your customized preZint solution.

Below are some of the key points of the demo.

Questionnaire

Complete a questionnaire to understand

your companies specific & unique challenges

Benefit: Tailored insights to ensure

your demo addresses your exact needs

Scheduling

After questionnaire, reserve a date / time for demo.

Demo is held at your office or desired location

Benefit: See preZint live in person

Live Demonstration

A sales representative & our expert will conduct a live demo at your desired location

Benefit: See for you industry how preZint can reduce operational costs by 30%